The AI+ Finance certification examines how Artificial Intelligence (AI) is changing financial industries. Basic AI concepts and finance applications demonstrate how AI algorithms can evaluate massive volumes of data for data-driven decision-making. This background is essential for understanding credit enhancement, where AI assesses creditworthiness more accurately and quickly than traditional approaches to optimize lending operations. The certification explores fraud detection and stock market predictions, showing how AI may alter these vital roles. AI can improve financial transaction security and record-keeping with blockchain technology, increasing trust and transparency in financial operations.

Learners would understand new technologies and practical implementation tactics to prepare them to use AI solutions in real-world situations. These AI solutions can help finance professionals expand their companies and navigate modern financial environments with resilience and inventiveness. The complete AI+ Finance certification prepares you to comprehend and implement AI-driven solutions, making them leaders in the fast-changing financial services industry. This holistic strategy prepares them to face present difficulties and seize new possibilities, propelling their businesses to success in the AI-driven financial future. We will cover the following topics to better understand the incorporation of AI in the Financial sector.

AI has revolutionized finance by introducing complex concepts such as ML and Deep Learning (DL). According to Statista report, the financial sector’s spending on AI is estimated to gradually increase from $35.03 billion in 2023 to $97 billion by 2027, with a progressive CAGR of 29% during the forecast period. Grasping these technologies is essential for comprehending AI in finance.

This module examines how AI is revolutionizing finance through data analytics, machine learning, and deep learning. AI enhances financial analysis, personalizes client interactions, and optimizes trading and risk management. It also strengthens cybersecurity and drives industry innovation. Additionally, the module highlights AI’s transformative impact on financial strategies and operations.

Data-driven decision-making in finance is crucial because it ensures decisions are based on accurate, comprehensive data, leading to more informed and effective financial strategies. It involves acquiring and managing diverse data sources, using advanced analytics for insights, and adhering to ethical and data protection standards.

This module focuses on finance-driven decision-making using diverse data sources, with an emphasis on data acquisition, cleansing, and management. It covers advanced analytics and visualization tools that provide deeper financial insights and improve communication. The module also explores AI’s role in enhancing investment strategies, risk management, and trading, highlighting its impact on efficiency and growth within the finance sector.

Enhancing credit and loans with AI is needed for more accurate and efficient evaluations. AI analyzes extensive data faster than traditional methods, automates loan processing, and personalizes financial products, improving accuracy and customer experience. This advancement also requires addressing regulatory and ethical concerns.

The key highlight of this module is on how AI enhances credit rating and loan origination in financial services. It covers AI-driven credit scoring for more accurate assessments, faster loan processing through automation, and personalized loan solutions that improve customer experience. The module also addresses the challenges of regulatory compliance and ethical considerations in AI implementation, emphasizing the need for transparency and fairness.

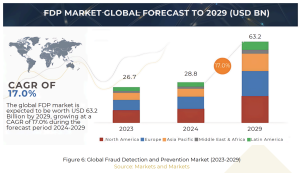

AI is essential for fraud detection in finance because it provides faster and more accurate identification of fraudulent activities than traditional methods. According to the Markets and Markets report, the global Fraud Detection and Prevention market size is expected to grow from $28.8 billion in 2024 to $63.2 billion by 2029, with a progressive CAGR of 17% during the forecast period.

This module focuses on how AI enhances financial fraud detection by leveraging advanced algorithms to analyze data, identify anomalies, and predict fraudulent activities. It covers the shift from traditional, error-prone methods to dynamic AI driven solutions, emphasizing the importance of real-time detection and the need for ethical transparency in fraud prevention.

AI is valuable for stock market forecasting because it provides accurate and timely predictions by analyzing large data sets and real-time information, helping investors make informed decisions and adapt to market fluctuations.

The module dives deep into the use of AI for stock market forecasting, focusing on techniques such as neural networks and sentiment analysis. It highlights how AI enhances prediction accuracy and trading efficiency. Data quality, market volatility, and regulatory compliance are some challenges also addressed. The module also emphasizes AI’s potential to transform stock market analysis with advanced predictive analytics.

Blockchain and AI are revolutionizing finance by enhancing efficiency through automation, ensuring security with decentralized and cryptographic methods, and increasing transparency in transactions and data management. These technologies streamline financial processes and improve trust and accuracy in financial operations.

This module explores how blockchain and AI are reshaping finance by enhancing efficiency, security, and transparency. It examines how blockchain’s smart contracts and decentralization are revolutionizing financial applications, while AI improves data management and scalability. The module also covers emerging innovations and future impacts on decentralized finance (DeFi) and automated trading, along with the ethical and regulatory challenges involved.

Emerging technologies such as AI, blockchain, and quantum computing are significantly impacting finance by enhancing efficiency, security, and accuracy. These technologies drive innovation, streamline processes, and reshape financial services.

This module covers the impact of FinTech on banking, payments, and lending, with a focus on enhanced user experiences and financial inclusion. It explores advancements such as quantum computing, AI, and automation in financial modeling, trading, and operations. Additionally, the module addresses the importance of ethical considerations, cybersecurity, and regulatory compliance to ensure responsible innovation in finance.

Implementing AI strategies in finance is essential for boosting efficiency, accuracy, and decision-making, helping institutions stay competitive and adapt to rapid technological changes.

This module focuses on adopting a digital-first approach for AI in finance, emphasizing the importance of strategic digital transformation. It examines how AI and emerging technologies enhance efficiency and decision-making, reshaping roles and skills in the financial sector. The module also covers preparing for technological disruptions and making responsible investment decisions to ensure a sustainable and competitive future.

If you need further information about this course, please contact: